Our services

Our services

OUR SERVICES

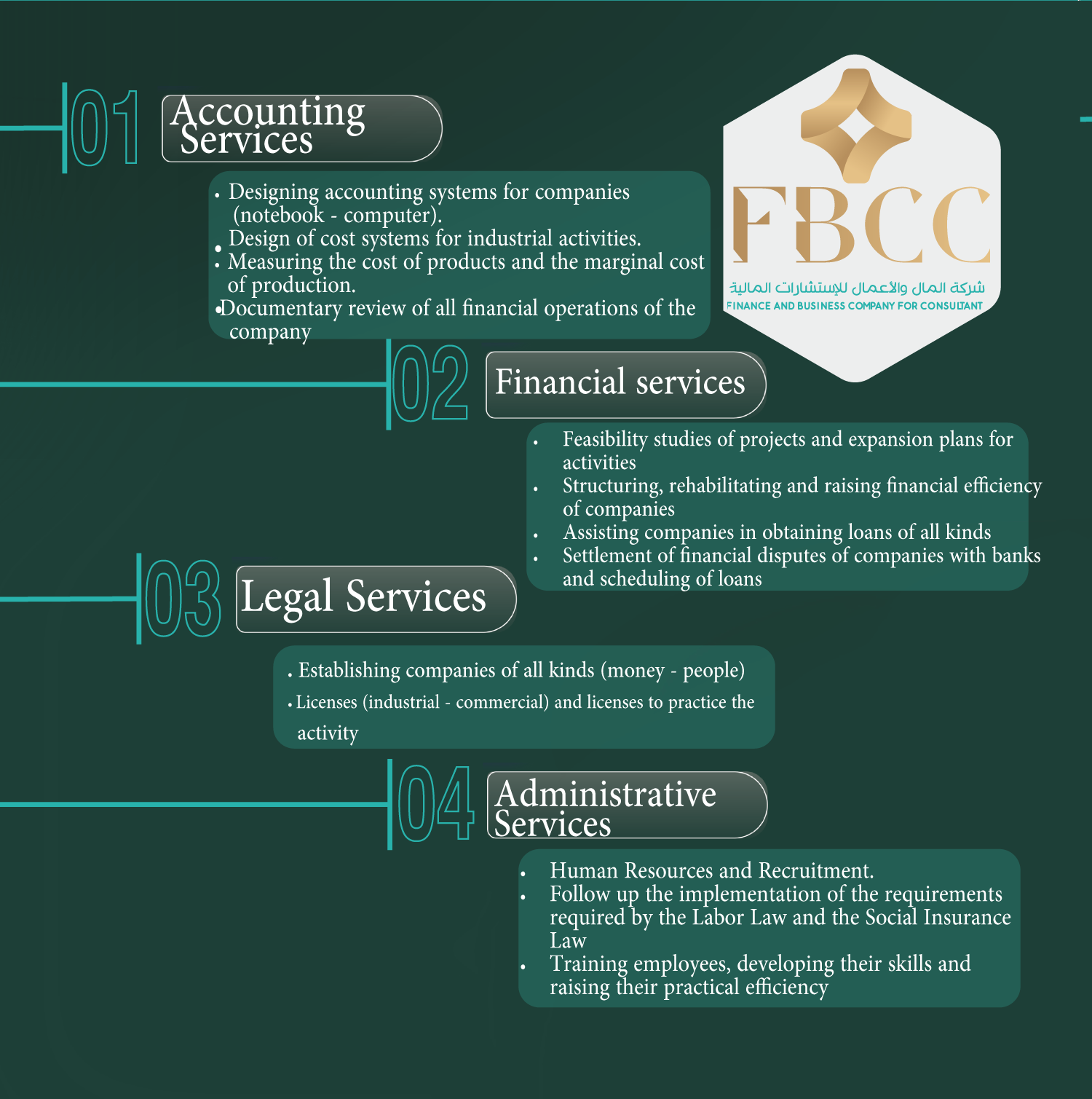

accounting services

administrative services

Finance services

administrative services

WEALTH MANAGMENT

ASSET MANAGEMENT

administrative services

GENERAL ADVICE

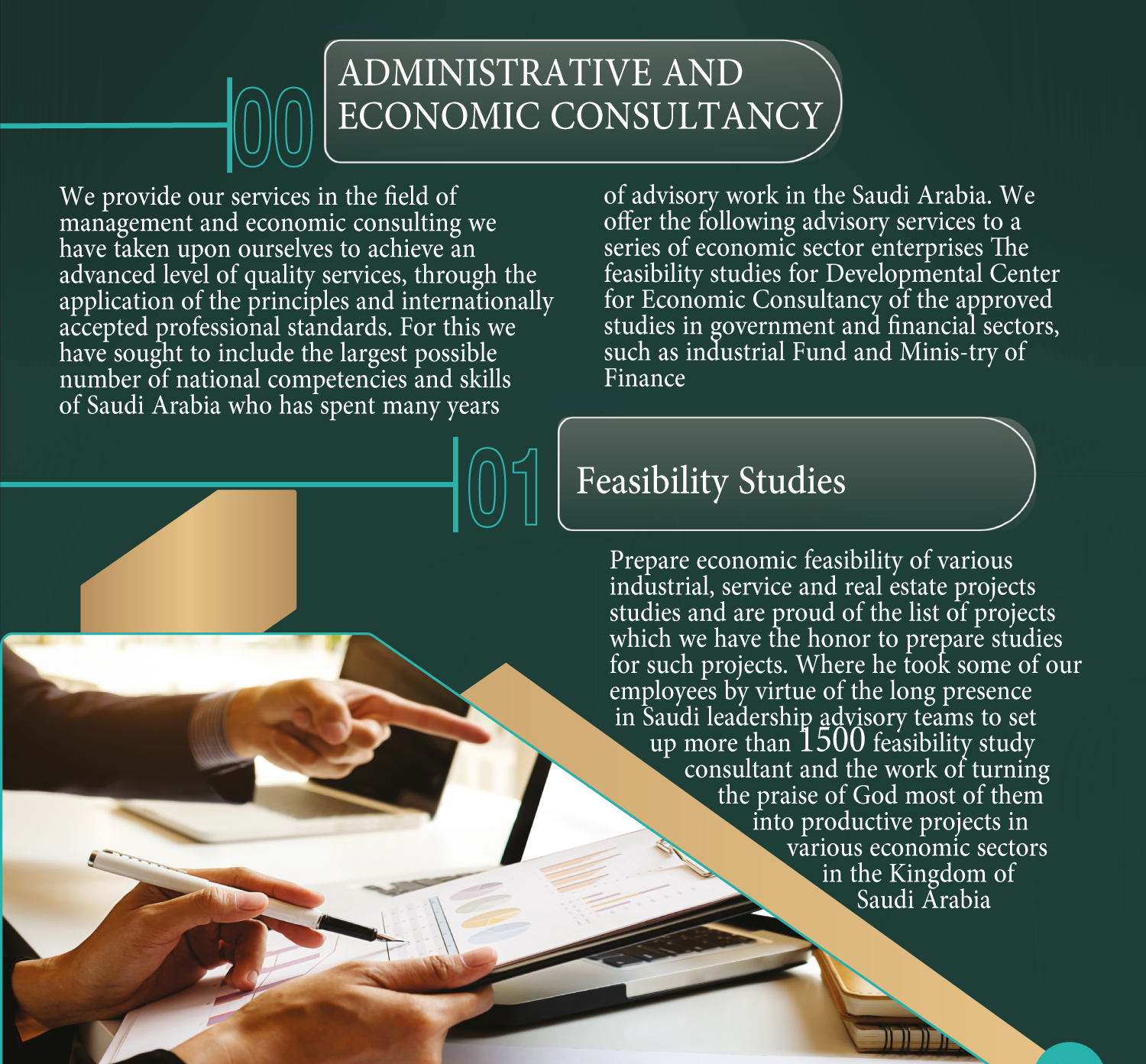

ADMINISTRATIVE AND ECONOMIC CONSLTANCY

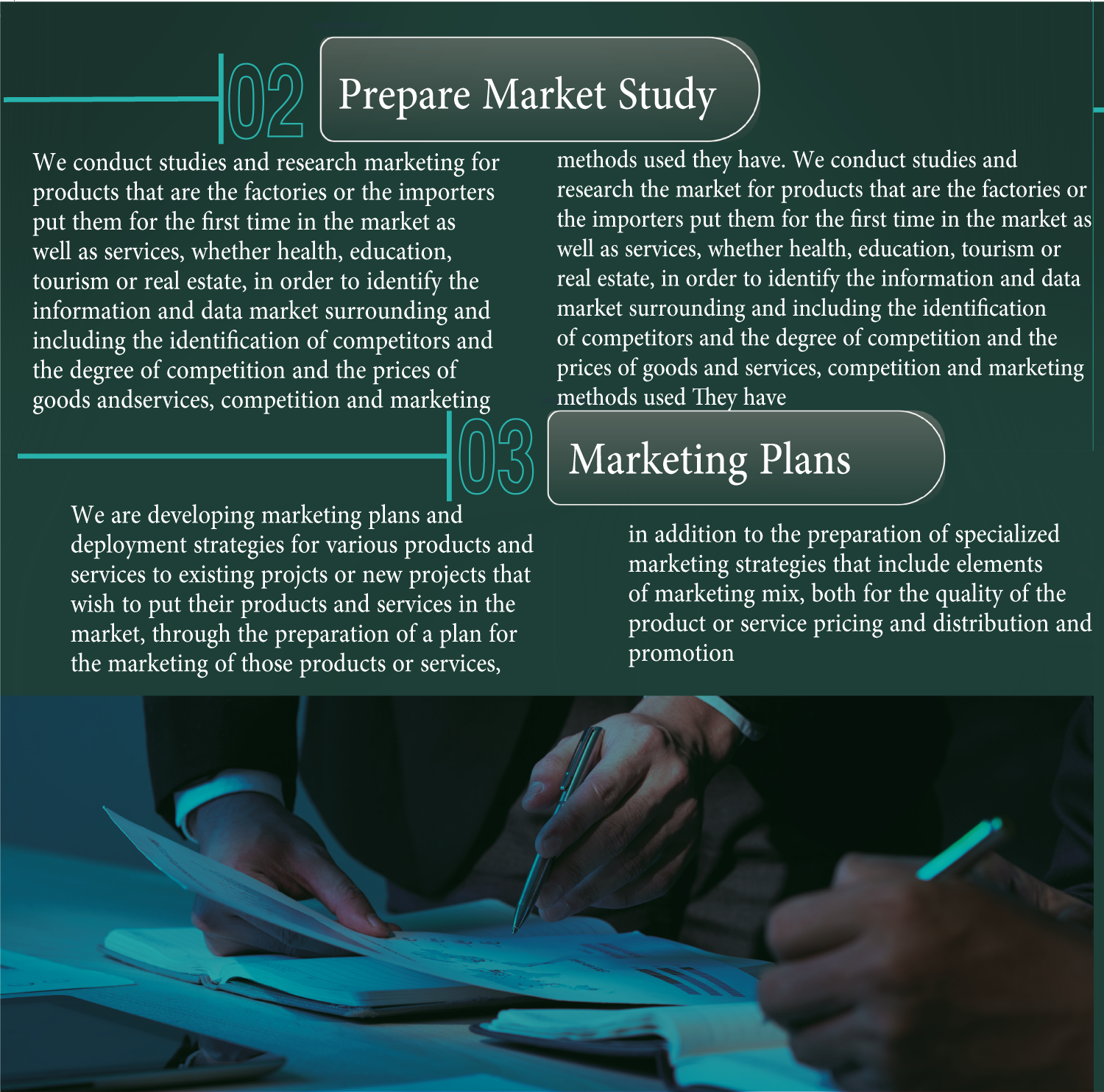

Our Services

#1

Accounting Services

Our accounting services for the client include all elements of

proof of financial operations and the first of these elements

First: Designing the appropriate accounting system for the company

In order for the accounting system to be economically

feasible, it is required to be efficient and effective, that is,

when preparing and designing financial accounting systems

for each company, it must take measures and procedures

in accordance with the nature of its activity and the volume

of its dealings with others, manually and using computers,

whether integrated programs or programs that are specially

designed according to the circumstances and nature of each

company.

1 – Designing a documentary control system in a practical and effective manner according to the nature of the activity and the volume of the company’s dealings with others to ensure financial control and periodic review of the company’s accounts so as not to accumulate errors and lose the rights of the company party of others

2 – Design a warehouse control cycle commensurate with the nature of the goods in which the company deals, which need a special control nature, for example (food stocks – medicines and medical supplies).

1 – Designing a documentary control system in a practical and effective manner according to the nature of the activity and the volume of the company’s dealings with others to ensure financial control and periodic review of the company’s accounts so as not to accumulate errors and lose the rights of the company party of others

2 – Design a warehouse control cycle commensurate with the nature of the goods in which the company deals, which need a special control nature, for example (food stocks – medicines and medical supplies).

Second: Design of cost systems for industrial activities

The most appropriate methods are followed for the nature of

the activity and the method of production to limit the costs of

the activity, both direct and indirect, in order to reach

to the real cost of the product so that the project

management can:

A- Determining a selling price that covers all production and administrative costs.

B – Analysis of cost elements in a scientific way that makes it easier for the project management to determine the causes of imbalance in the high cost and how to address these points

c – Analysis of cost elements scientifically enables the project management to maximize the benefit of them.

D – Analysis of the quantities of production at each production stage and compare them with the target of production and link them to the costs of each stage Productivity makes it easier for project management to reach the appropriate marginal cost in light of production capacity.

E – Analysis of cost elements in a scientific manner enables the project management to take the appropriate and useful decision in the event of competition in A specific field by reducing prices or giving certain discounts to attract customers and increase sales.

F- Analyzing the cost elements scientifically enables the project management to take the appropriate and useful decision in the event of a market recession in commodities

A- Determining a selling price that covers all production and administrative costs.

B – Analysis of cost elements in a scientific way that makes it easier for the project management to determine the causes of imbalance in the high cost and how to address these points

c – Analysis of cost elements scientifically enables the project management to maximize the benefit of them.

D – Analysis of the quantities of production at each production stage and compare them with the target of production and link them to the costs of each stage Productivity makes it easier for project management to reach the appropriate marginal cost in light of production capacity.

E – Analysis of cost elements in a scientific manner enables the project management to take the appropriate and useful decision in the event of competition in A specific field by reducing prices or giving certain discounts to attract customers and increase sales.

F- Analyzing the cost elements scientifically enables the project management to take the appropriate and useful decision in the event of a market recession in commodities

Third, measuring the cost of products and the marginal cost of production.

The company provides consulting services in the field

of industrial costs, as it helps the activity management

in reviewing and measuring industrial operating costs

and bringing them to the lowest levels so that the activity

management can compete and cover fixed costs and

achieve appropriate profits.

Fourth: Documentary review of all financial operations of the company

We periodically review all financial and legal transactions

in which the client is a party for the purpose of prevention

From being exposed to the loss of his rights by third

parties or to fall into any legal matter and is done:

1- Giving advice and advice on what to follow so that

mistakes are not repeated.

2 – Reports are submitted to the customer periodically

so that he is fully aware of all matters and financial

transactions related to his commercial activity

Financial services

#2

The Financial Services Department is the main nerve to support any new or existing company and is looking for financial advice for good disbursement of the resources available to the activity management in order to draw up the financial policy of the project, especially at the start of the activity and when the lack of available liquidity. Below we present some of our financial services

A- Feasibility studies of projects and expansion plans for activities

Through a team of specialists in financial and economic studies,

an economic feasibility study is prepared

For new projects or for a study of expansion plans for existing

projects on a scientific basis and practically applicable

On the ground, in addition to studying investment opportunities

and their economic feasibility, such as:

– The opportunity to acquire an existing project, whether with the same activity, complementary activity or a different activity, but there is a good investment opportunity. – Opportunity to expand by attracting new partners The opportunity to merge one activity with another activity to increase competitiveness and control a particular commodity market

– The opportunity to acquire an existing project, whether with the same activity, complementary activity or a different activity, but there is a good investment opportunity. – Opportunity to expand by attracting new partners The opportunity to merge one activity with another activity to increase competitiveness and control a particular commodity market

B - Structuring companies, rehabilitating them and raising their financial efficiency.

Some companies are exposed to financial shocks as a result

of market conditions or as a result of miscalculation of market

forecasts by the management of the activity. Therefore, one of

the most important points that we pay attention to is to provide

technical support to manage the customer’s activity through

1- Studying the sources of funding that depend on them.

2- Studying the policy of belonging granted by the customer in question to his customers.

3 – Study the strengths and weaknesses of the policy followed.

4 – Propose solutions and alternatives to address liquidity problems.

1- Studying the sources of funding that depend on them.

2- Studying the policy of belonging granted by the customer in question to his customers.

3 – Study the strengths and weaknesses of the policy followed.

4 – Propose solutions and alternatives to address liquidity problems.

C - Assisting companies in obtaining loans of all kinds

It is important for companies wishing to obtain financing

to identify the most suitable financing alternatives for the

company before applying to any of the financing institutions,

so we provide some guidance regarding the conditions and

documents that are usually required by each type of financing

institution, which must be prepared before applying to any

financing entity.

1 – Ensure the need of the activity for funding.

2 – Determine the type and size of the facility required.

3 – Preparation of the client’s affiliation file.

4 – Comparison between the best banking offers and the best interest rates and commissions

5 – Apply to the bank to obtain the required facility.

6 – In the absence of good financial management, we follow up on the facility and ensure that it is disbursed as required On behalf of the client

1 – Ensure the need of the activity for funding.

2 – Determine the type and size of the facility required.

3 – Preparation of the client’s affiliation file.

4 – Comparison between the best banking offers and the best interest rates and commissions

5 – Apply to the bank to obtain the required facility.

6 – In the absence of good financial management, we follow up on the facility and ensure that it is disbursed as required On behalf of the client

D. Settlement of financial disputes of companies with banks and scheduling of loans

In the event of financial shocks to the customer and default for

any reason, we are the ones who study the reasons for default

and non-payment, propose solutions to the customer, and

make a settlement and scheduling of debts after negotiating

with the creditor bank or lenders

Generally on the size of the debt, the method of payment and

the dates

Financial & Legal Advice

#4

Financial leasing consultancy (purchase of equipment –

machinery – production lines – cars)

Mortgage Consultancy

Scheduling or settling bad debts with banks

Collection of debts in favor of others

Factoring Consulting

Electronic establishment of all individual companies,

limited partnerships, solidarity and joint stock companies

Providing all investor services from inside the Arab

Republic of Egypt or from abroad

Legal advice (criminal – civil – commercial – violations –

misdemeanors) drafting all types of contracts.

Registration, renewal and amendment of contracting

companies in the Egyptian Federation of Building and

Construction Contractors

Legal Services

#3

A- Establishing companies of all kinds (money - persons).

The company includes a team of lawyers specialized in

establishing companies of all kinds, including companies of

persons (partnership – simple recommendation) and money

companies (joint stock – limited liability)

The most appropriate ones for the client are determined according

to the nature of the activity, the size of the invested capital, the

nature of the expected partnership, and the legal adaptation of

the status of each partner so that the client can establish his own

activity in the best appropriate legal entity so as not to lose any

legal advantages or facilities in another law in a timely manner and

at the lowest possible cost, in addition to:

1- Opening a tax file

2- Extracting the commercial register.

3- Registration in the importers register.

4- Registration in the exporters register.

5- Registration in the agents register.

1- Opening a tax file

2- Extracting the commercial register.

3- Registration in the importers register.

4- Registration in the exporters register.

5- Registration in the agents register.

B-Licenses (industrial - commercial) and licenses to practice the activity.

The company extracts the necessary licenses for commercial

and industrial purposes, which are required in order to start any

activity by practice, including:

1- Industrial licenses, including: A- Licenses for the establishment of factories, including (physical approval – building permit – operating license) and the subsequent permit procedures Entities (civil defense and evidence) in addition to the introduction of utilities for the activity (electricity – water – gas).

B – Extraction of the industrial register of industrial establishments

1- Industrial licenses, including: A- Licenses for the establishment of factories, including (physical approval – building permit – operating license) and the subsequent permit procedures Entities (civil defense and evidence) in addition to the introduction of utilities for the activity (electricity – water – gas).

B – Extraction of the industrial register of industrial establishments

Ask for a quick consultation

Ask for an offer

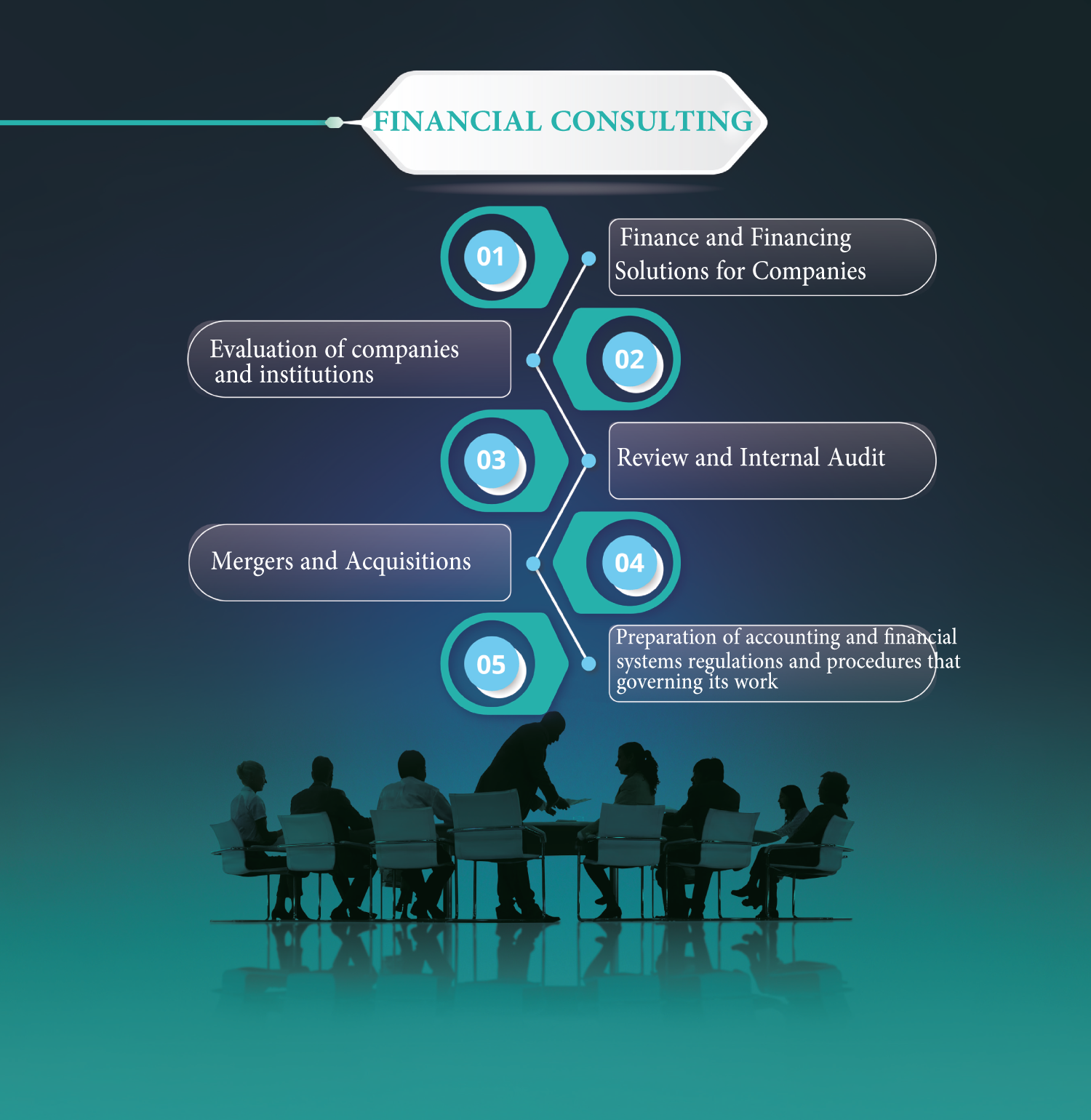

Financial advisors and financial advisors have the ability to read the political reality and its impact on the economic situation

As well as dealing with all the financial data available to the company and how to guide the continuation of the company in all circumstances

political and economic.